Registering as a VAT vendor with SARS may seem daunting as it brings about new regulations that an entity needs to comply with. However, when all the legal jargon that makes up the VAT Act has been removed the requirements for VAT invoices become relatively easy to understand. Let’s look at the SARS VAT Invoice Requirements to ensure you have all the correct information on your Tax Invoices.

Before getting into the requirements of a VAT invoice it is important to know why adhering to these requirements is beneficial to a business. VAT registered businesses are obligated to file a VAT return (most commonly bi-monthly) with the Receiver of Revenue. VAT raised on sales invoices constitutes monies owed to SARS and often these amounts can seem excessive, especially to small to medium-sized enterprises (or SME’s). In order to reduce this amount, the VAT Act allows for the VAT portion of expenses incurred in the course of running the business to be set off against the VAT on sales invoices.

For example, a sales invoice for an amount of R100 will have 15% VAT added to it giving it a total of R115. R15 is thus the amount payable to SARS and is referred to as Output VAT. However, a business expense (such as Telephone or Internet costs) to amount of R57.50 carries a VAT portion of R7.50 (also known as Input VAT). These two amounts are deducted from each other to determine how much should be paid to SARS (R15 – R7.50 = R7.50)

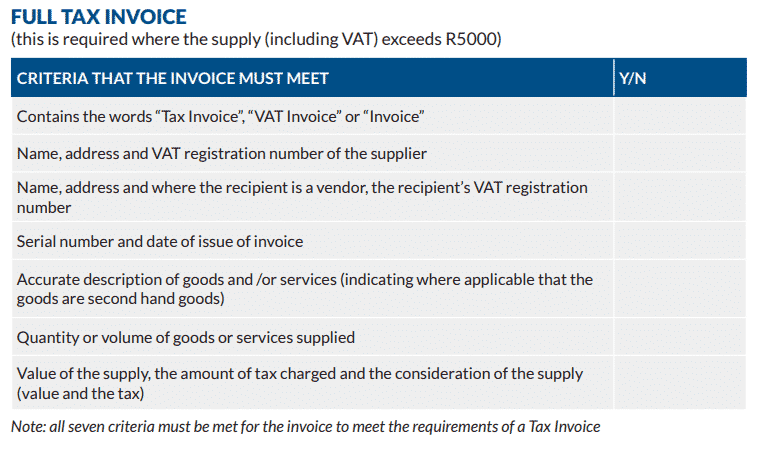

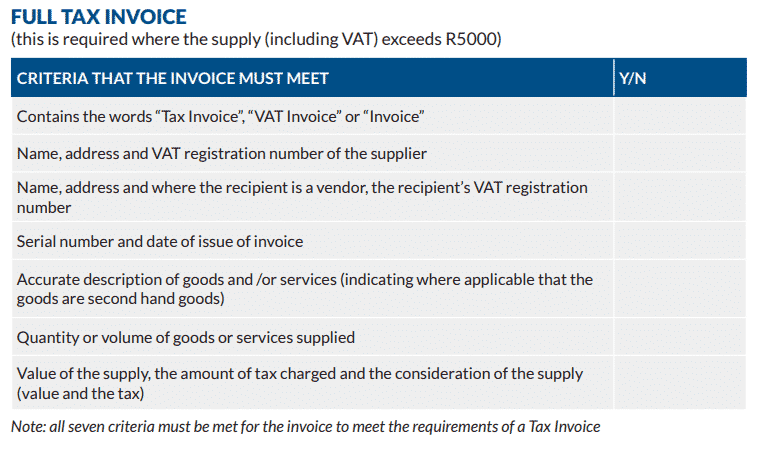

Any invoice not containing all of the above requirements may be excluded by SARS. The amount excluded will then become due and payable by the VAT vendor. The VAT Act also prescribes the timeframe within which a tax invoice must be issued (i.e. 21 days from the time the supply was made).

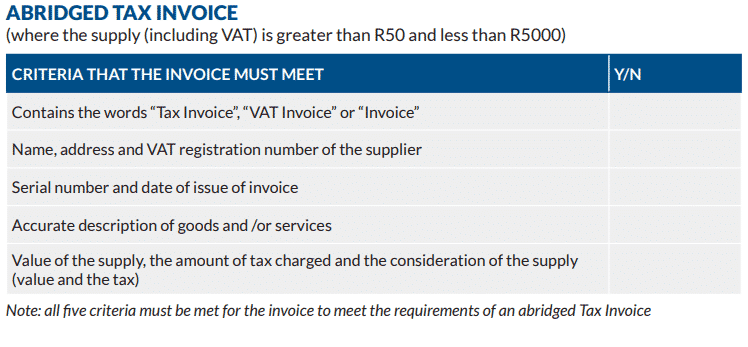

When the invoice issued is totaled at R5000 or less an abridged tax invoice will be acceptable. This type of invoice does not need to reflect the following:

If the supply of goods is less than R50 no tax invoice is required. But a slip or sales docket indicating the VAT is required.

About the Author:

CFO360 offers comprehensive solutions to simplify matters for your company. Services range from accounting systems and monthly bookkeeping to tax preparation and compliance services. Led by Professional Accountants and servicing hundreds of small businesses. They’ve dealt with many small businesses going through a difficult period. Arrange a call with an Accountant to find out more.